Amid declining market interest rates and the gradual uptick in domestic demand, credit growth of the Banking sector witnessed a resurgence particularly in terms of the private sector while the dependence of State Owned Enterprises declined mainly due to the Central Government absorbing certain credit facilities of a major State Owned Enterprise.

Profitability of the Banking sector also improved, significantly supported by the increase in net interest income, according to Financial Stability Review 2024 of the Central Bank. Meanwhile the performance of both the Finance Companies (FCs) sector and the Insurance sector depicted an overall trend consistent with that of the Banking sector, highlighting the impact of improved macrofinancialconditions within the financial sector as a whole.

Accordingly, the FCs sector also reported an improved performance despite the saturation in vehicle leasing activities. Assets of the sector improved, both in terms of quantity and quality, while liquid assets of the sector also recorded a growth with increased investments in Government securities.

Meanwhile, similar to the Banking sector, reduced interest costs supported profit expansion while the capital adequacy levels of the sector also improved. Likewise, developments within the Insurance sector depicted an improvement during the period, as reflected through the increase in Gross Written Premium.

Further, a notable asset growth was observed due to the significant growth in assets of the long term insurance subsector with continued increase in investments in Government securities. Profitability also improved amidst robust levels of capital adequacy within the insurance industry. Accordingly, the recovery, stabilisation and gradual growth of the banking, finance companies, and insurance sectors, were particularly influenced by he developments in the interest rate structure and continued investments in Government securities. Household and Institutional sectors, which constitute key financial services consumers, recorded an expansion in credit during the first half of 2024.

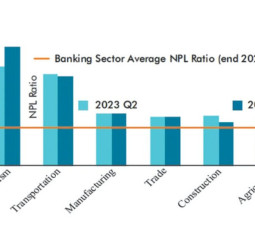

This reflects the uptick in the demand for financial services from these sectors within the backdrop of improving macroeconomic conditions in the economy. The Tourism sector has reported a significantly high NPL Ratio of 40 per cent, despite the improved performance of the sector in recent periods.

Nevertheless, the Tourism sector represented only 3.8% of the total credit of the Banking sector, indicating a lesser impact of default risk to the overall Banking sector Going forward, the financial system is expected to perform better with envisaged improvements in asset quality and buildup of capital buffers while prudently managing risks, as the economy further stabilises and advances amidst continuing challenges.

Although the unprecedented gravity of the crisis created deep macrofinancial imbalances within the economy, these imbalances are gradually correcting with prudent policy measures and reforms along with behavioural responses thereby supporting financial system stability.

Foreign participation up in stock market

Foreign participation in the stock market improved during the first eight months of 2024 compared to the corresponding period of 2023, yet net foreign inflow to the secondary market was negative.

Foreign purchases of USD 119.4 million were recorded in the period under review, compared to foreign purchases of USD 94.4 million recorded for the same period of 2023. However, on a net basis, foreigners were sellers in the secondary market.

On the contrary, net foreign buying was recorded over the past two years. Eight months ending in August 2024 recorded a net foreign outflow of USD 17 million compared to the net foreign inflow of USD 14.7 million recorded during the same period in 2023. Along with the anticipated continuation of macroeconomic stability, securing inflows which are long term in nature to the stock market will help stabilize the domestic foreign exchange market.

Mifra

Mifra