PMF Finance PLC’s transformation over the past several years stands as testimony of corporate revival. Once mired in crisis, the institution has emerged as a credible and resilient financial services provider, achieving sustained profitability, restoring stakeholder trust, and positioning itself as a dynamic force in the sector.

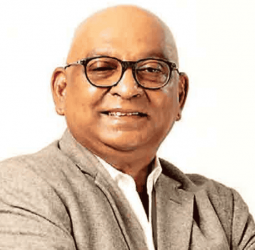

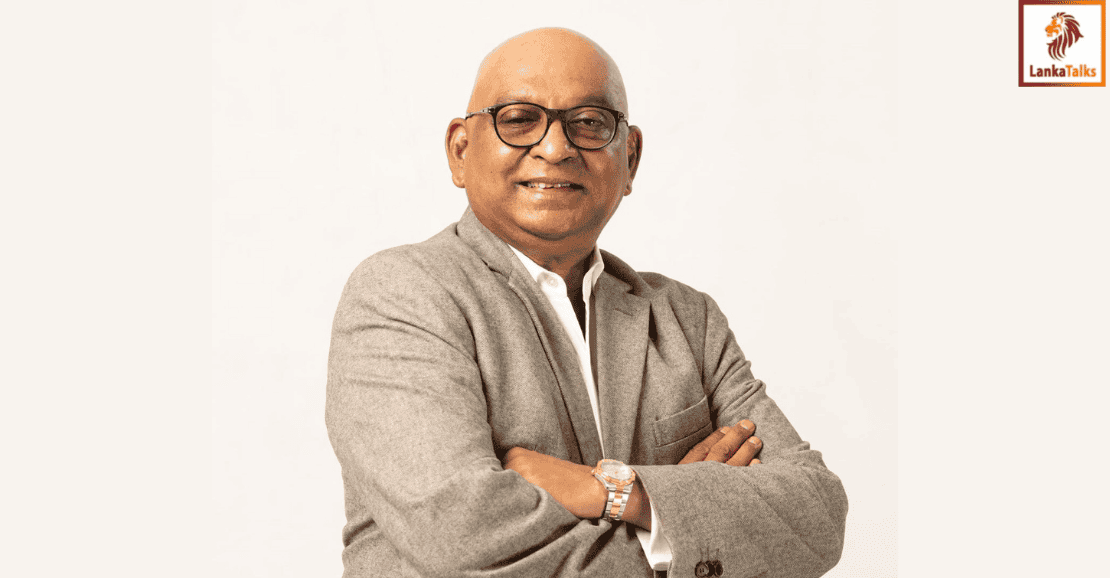

When Chandula Abeywickrama assumed the role of Chairman in 2019, the company was struggling to stay afloat. The financials painted a dire picture: a loss of Rs. 93 million, a total asset base of just Rs. 2.8 billion, and eroded credibility in the marketplace. Depositors were pulling out, and the company had become synonymous with risk, non-compliance, and weak governance. Internally, the culture was fractured, and systems were crumbling. Yet, under his direction, the company embarked on a disciplined restructuring agenda—one that would, over the years, completely redefine its trajectory.

The first order of business was to reconstitute the Board of Directors with individuals of high integrity and proven financial expertise. This marked the beginning of a new governance era for PMF. Board members such as Channa Manoharan, Rasika Gunawardena, the late Duleep Daluwatte, and Rangana Koralage—representing the main shareholder Sterling Holdings—were brought in to establish strong oversight and strategic direction. Over time, the Board was further strengthened with the appointments of Travis Waas, a respected operational expert with over 30 years in leasing and finance; Dr. Nirmal de Silva, who brought valuable perspective on entrepreneurship, SME development, and impact investing; and Krystle Reid Wijesuriya, a recognised figure in youth empowerment and disability inclusion. In 2024, this foundation was bolstered with the addition of Rohan Pandithakorralage, a seasoned HR strategist; K.M.D.B. Rekogama, an engineer and MSME banking consultant; Ashoka Goonesekere, a former CFO and CRO with deep audit and risk management credentials; and Kaniska Weerasinghe, a legal authority and former Director-General of the Employers’ Federation of Ceylon. Together, this Board has shaped a high-performance culture, reinforced compliance, and signalled a strong message of credibility to regulators and stakeholders alike.

The turnaround at PMF is not only evident in governance but also in the numbers. From 2019 to 2025, the company’s gross income grew at a compound annual growth rate (CAGR) of 38.09%, reaching Rs. 4.27 billion in the last financial year. Net interest income followed with a CAGR of 47.54%, amounting to Rs. 1.95 billion. The most compelling transformation came at the bottom line, where PMF reversed a Rs. 93 million loss in 2019 to a Rs. 322 million profit in 2025, reflecting a 219% CAGR in profitability. The total asset base rose to Rs. 21.6 billion, loans and receivables increased to Rs. 17.17 billion, and the deposit base expanded to Rs. 14.4 billion. Shareholder equity grew from Rs. 143 million to over Rs. 3 billion—an impressive 55% CAGR.

Performance in Q1 2025 has further cemented PMF’s turnaround. Gross income increased 23% year-on-year to Rs. 1.22 billion, while net interest income rose 63% to Rs. 680 million. Operating profit before tax more than tripled to Rs. 187.9 million, and profit for the quarter reached Rs. 77.3 million, up from Rs. 40.6 million the previous year. A particularly significant milestone is the Rs. 110 million paid in taxes this quarter, compared to Rs. 19 million in the same period last year—a sign of not just profitability but regulatory contribution. The company’s total asset base has now grown to Rs. 22.3 billion, with a portfolio of Rs. 18.1 billion and fixed deposits at Rs. 14.2 billion. The NPL ratio has drastically dropped to 6.95%, down from nearly 30% at the start of the journey.

This growth was not accidental. It was a result of patient, principled decision-making and strategic leadership that prioritised long-term sustainability over short-term fixes. At a time when mobilising deposits was a struggle due to the company's poor legacy image, it was the personal credibility and reputations of the board members that attracted early depositors—friends, relations, and business networks that placed their trust not in the brand, but in the people behind it. This trust was rewarded, and PMF has since restored public confidence at scale, gaining traction in the market and increasing its visibility and relevance in the financial sector.

With a lean structure, agile branch network, and empowered team, PMF is now positioned to move beyond traditional financial services and explore innovative revenue models that align with national priorities and stakeholder interests. The company’s smaller size and flat structure provide the flexibility to adapt quickly to opportunities, and its enhanced image has unlocked access to more funding, deposits, and partnership potential.

For PMF Finance PLC, the past seven years have been a study in revival, responsibility, and resilience. Today, it is not just a restructured company—it is a reimagined institution, prepared to scale impact, deliver value, and sustain its mission in a dynamic economic landscape.

Natasha

Natasha