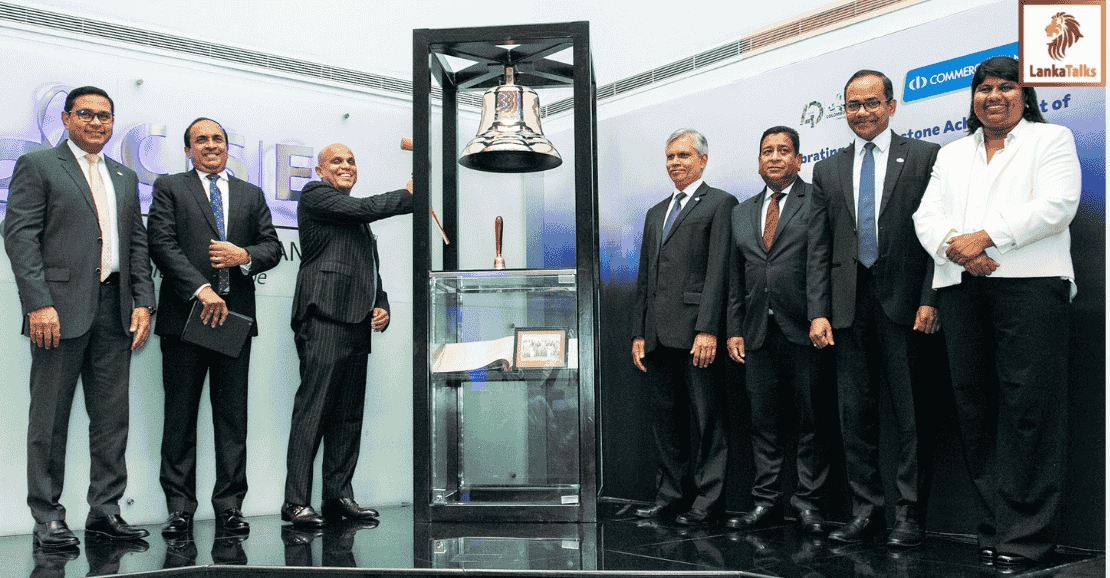

Rings ceremonial bell at Colombo Stock Exchange to celebrate milestone

The Commercial Bank of Ceylon PLC’s milestone of becoming the first bank in Sri Lanka with a market capitalisation of more than US$ 1 billion was celebrated at the Colombo Stock Exchange (CSE), where the Bank was invited to ring the ceremonial bell.

Commercial Bank Chairman Mr Sharhan Muhseen, Managing Director/CEO Mr Sanath Manatunge, members of the board, and corporate and senior management participated in this symbolic recognition of another landmark in the Bank’s remarkable history which further reinforces its financial and operational leadership.

The Bank’s market capitalisation surpassed the landmark US$ 1 billion value with the increase in its share price to Rs. 196.75 at the end of trading on 19th August 2025, up from Rs. 144.75 per share recorded at end December 2024.

“Crossing the US$ 1 billion threshold marks Commercial Bank’s transition into large-cap territory, enhancing our visibility in global capital markets and positioning us for broader inclusion in institutional portfolios and index funds,” Commercial Bank Chairman Mr Sharhan Muhseen commented. “In addition to increased market recognition, the larger market capitalisation also improves our access to capital and credit markets, enabling us to pursue new opportunities, invest in innovation, and accelerate value creation for our shareholders.”

Colombo Stock Exchange Chairman Mr Dimuthu Abeyesekera said Commercial Bank has joined the distinguished ranks of only two other listed companies on the CSE that have crossed the billion-dollar threshold, making it the third Sri Lankan company to be valued at such scale. “This is a proud moment for the Bank, the Colombo Stock Exchange and the nation, but more importantly, it is a powerful signal of the progress our equity market is making. Achievements like this directly contribute to our journey, as every billion-dollar company added to our market strengthens credibility, broadens investment appeal, and positions Sri Lanka more firmly on the global investment map,” he said.

“This is an extremely significant milestone for the Bank and its shareholders,” Commercial Bank Managing Director/CEO Mr. Sanath Manatunge said. “It reflects the strength of our business model and the confidence our investors continue to place in us. We have always focused on equitable growth, balancing national economic and social imperatives, the aspirations of our customers and the creation of stakeholder value. This milestone is the result of this commitment to delivering sustainable value.”

In the second quarter of 2025 the Commercial Bank of Ceylon became the first private sector bank in Sri Lanka to surpass Rs. 3 trillion in assets, with a growth of Rs. 255 billion (8.88%) at Group level and Rs. 242 billion (8.66%) at Bank level respectively over the six months ending 30th June 2025.

The Commercial Bank was also ranked the second most valuable brand in Sri Lanka across all sectors and the most valuable private sector bank brand in the country for 2025 by Brand Finance, the world’s leading brand valuation consultancy.

The first Sri Lankan bank to be listed among the Top 1000 banks of the world, Commercial Bank has the highest capital base among all Sri Lankan banks, is the largest private sector lender, the largest lender to the SME sector, a leader in digital innovation and is Sri Lanka’s first 100% carbon-neutral bank.

Commercial Bank operates a network of strategically located branches and automated machines island-wide, and has the widest international footprint among Sri Lankan banks, with 20 branches in Bangladesh, a fully-fledged Tier I Bank with a majority stake in the Maldives, a Microfinance company in Myanmar and a representative office within the Dubai International Financial Centre (DIFC). The Bank’s fully owned subsidiaries, CBC Finance Ltd. and Commercial Insurance Brokers (Pvt) Limited, also deliver a range of financial services via their own branch networks.

Natasha

Natasha