The shift towards digitalization of government institutions is finally happening and more public entities are falling in line with this, Governor Central Bank, Dr. Nandalal Weerasinghe said at the Central Bank Policy Agenda 2025 event yesterday.

The Central Bank continued to enhance the national payment infrastructure further by way of integrating into regional and country payment networks during 2024.

“Further, with a view to ensuring that Sri Lanka’s payment infrastructure is compliant with international standards, the ISO 20022 implementation project completed its first phase in 2024 by introducing a new Real Time Gross Settlement (RTGS) System.”

“In addition, the Central Bank played an active role in developing the government digital payment platform (GDPP), which is an initiative aimed at improving citizen-government interactions and streamlining payment processes for various government services in Sri Lanka.”

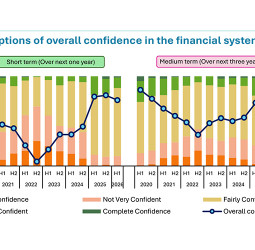

Meanwhile, commenting on the financial stability in both banking and insurance sectors he said that they have made robust progress and have consolidated their positions further. “The financial system remained resilient and showed greater stability in 2024.”

The recovery in credit to the private sector has been supported by the noteworthy reduction in market lending interest rates. However, the Central Bank observes some excessive, outlier rates of interest on facilities extended to Micro, Small and Medium Scale Enterprises (MSMEs) as well as marginal borrowers and certain credit products, which are not consistent with the prevailing relaxed monetary policy stance.

“Hence with a view to making low interest rate credit accessible, the Central Bank will closely work with banks and other financial institutions to reduce the excessive interest rates still prevalent in the market.”

He also disclosed that the Central Bank purchased the highest-ever annual amount of foreign exchange from the domestic foreign exchange market in 2024, exceeding USD 2.8 billion (net).

“Gross official reserves increased to around US dollars 6.1 billion by the end of 2024 compared to US dollars 4.4 billion at end 2023.”

With normalcy being restored and stability attained through the implementation of much-needed sound macroeconomic policies, including monetary policy, the Central Bank’s focus going forward will be on stabilising inflation around the target of 5%, from the current deflation and this is expected to happen mid-2025. These achievements are outcomes of the continued commitment and perseverance and the sacrifices made by all stakeholders of the economy, including the general public, in pursuing the economic reform agenda.”

While broad-based stability has been achieved, the focus, going forward, would be on fostering sustained growth, which requires driving innovation, enhancing productivity, maintaining a strong commitment to implementing structural reforms and encouraging greater stakeholder collaboration without compromising hard-earned stability.

The governor also disclosed that the Central Bank, with the coordination of the Colombo Port City Economic Commission will facilitate the conduct of offshore banking business through required regulatory and supervisory functions.

EPF surpasses Rs 4 Tn in 2024

Shirajiv Sirimane

The Employees’ Provident Fund (EPF) managed by the Central Bank, which is the country’s largest superannuation fund, has surpassed Rs. 4 trillion in 2024, the CBSL Governor said.

“EPF is implementing several solutions including digitalisation of records and online payments for member contributions to enhance operational efficiency. Undoubtedly, the introduction of online payment avenues will provide convenience and flexibility to the employers in making their EPF contribution payments and this shift will further streamline processes and reduce administrative burdens. While strengthening the contribution collection procedures with modern solutions, several actions are planned to be executed to enhance the efficiency in providing the pre- and post-retirement benefits to the members.”

The Governor also disclosed that EPF is exploring opportunities to diversify its investment portfolio to achieve a higher risk-adjusted rate of return, while ensuring the safety and long-term sustainability of the Fund.

“By adopting these measures, the EPF aims to maintain its commitment to providing secure and stable retirement benefits for its members.”

Moreover, ICT infrastructure is expected to be modernised to reengineer the existing systems and procedures. This comprehensive ICT solution will facilitate the automation processes, leading to more effective management of the fund.

Source: Daily News

Mifra

Mifra