As the Sri Lankan economy shows signs of recovery, the risks associated with the domestic macro financial conditions, although persistent, are progressively diminishing, says the Central Bank.

Macro financial stability is gradually being restored with decline in market interest rates with the accommodative monetary policy stance along with falling inflation and lower risk premia, which resulted in a partial correction of interest rate anomalies, supported the gradual uptick in credit, strengthened rupee and improved business conditions.

Moreover, the tilt in financial sector exposure towards the public sector also showed signs of correction, indicating an improvement in the allocation of financial resources towards the private sector Despite significant challenges, Sri Lanka’s Fiscal sector performed well thus far in 2024, while continued progress is required to manage future financing requirements. The implemented fiscal consolidation measures led to improvements in all key fiscal balances.

Robust revenue based consolidation measures are key contributors to this progress. The successful completion of the DDO in 2023 and the finalisation of the EDR in 2024 would further dissipate uncertainties and restore investor confidence.

The All Share Price Index also reported a year-to-date increase after a declining trend was witnessed from mid-2024 amidst possible uncertainties with the election cycle.

Resilience of financial institutions gradually improved during the first half of 2024 amidst easing macroeconomic conditions as reflected by key financial soundness indicators of the Banking sector, such as credit quality, liquidity and capital adequacy. Profitability of the Banking sector also improved, significantly supported by the increase in net interest incomes.

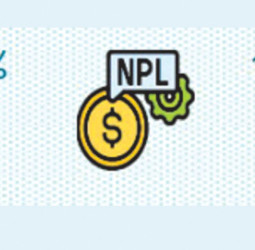

However, the Non-Performing Loans (NPL) ratio remained elevated highlighting continued challenges while the provision coverage ratio improved.

Amid declining market interest rates and the gradual uptick in domestic demand, credit growth of the Banking sector witnessed a resurgence particularly in terms of the private sector while the dependence of State Owned Enterprises declined mainly due to the Central Government absorbing certain credit facilities of a major State Owned Enterprise.

However, the impact of past adverse developments such as elevated price levels, diminished real income levels, and rigidities in the labour markets remain as challenges to the macroeconomic as well as financial stability.

“Going forward, the financial system is expected to perform better with envisaged improvements in asset quality and buildup of capital buffers while prudently managing risks, as the economy further stabilises and advances amidst continuing challenges.”

Mifra

Mifra