The APAC chapter of the Public Relations and Communications Association (PRCA), the world’s largest and influential PR body, together with its board member and communications expert Thanzyl Thajudeen carried out a survey among 31 agency leaders and executives to explore the current and future context of Sri Lanka’s PR industry.

This comes as the second survey, following the first one on October 2022. The respondents once again cited the PR industry as being highly competitive with its own challenges, and one fourth shared positive sentiments that it has improved.

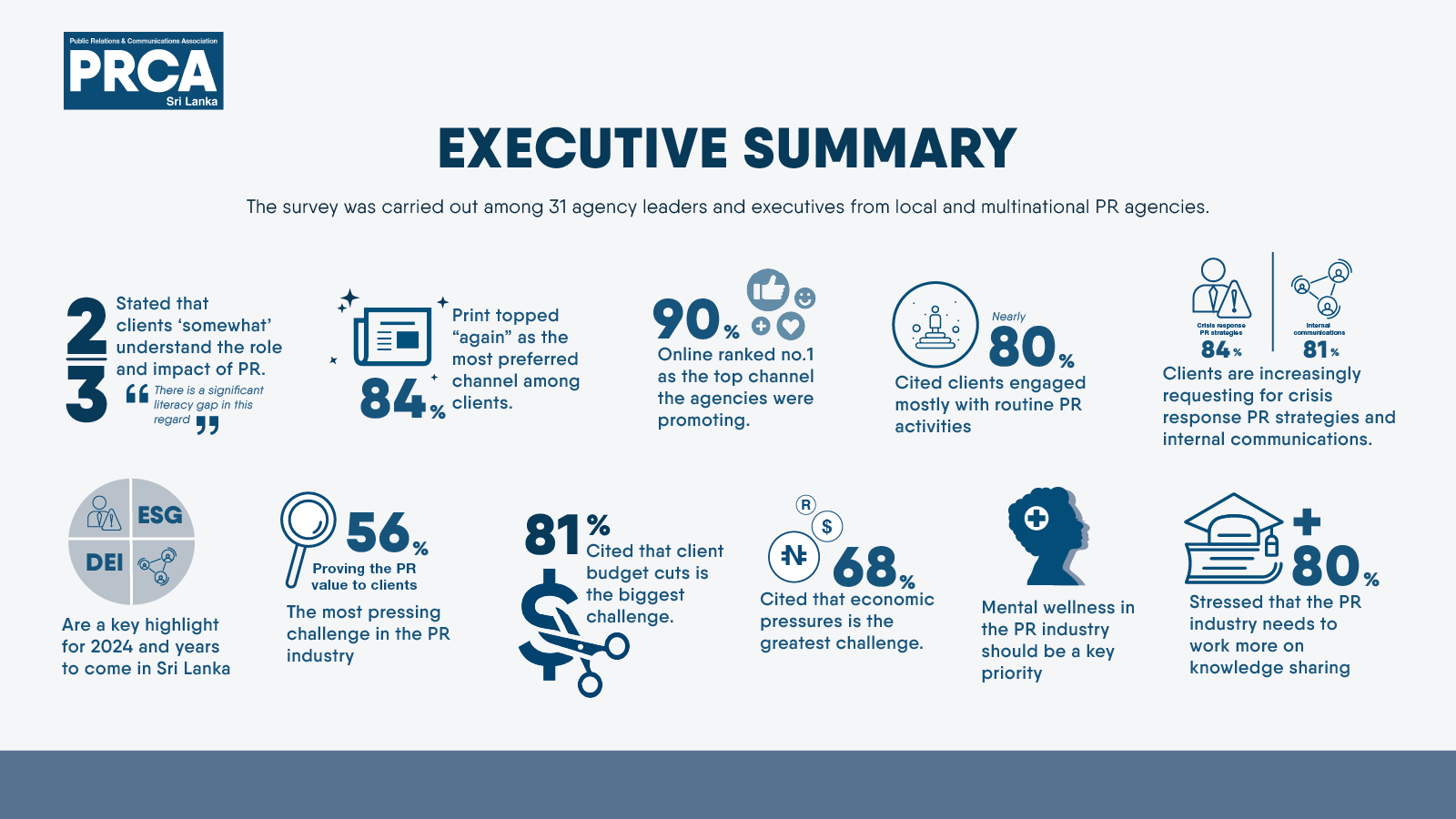

Over two-third of those surveyed said that clients ‘somewhat’ understand the role and impact of PR, commenting that there is a significant literacy gap in this regard. When asked about which channels do clients prefer the most, print once again topped the list (84pct) followed by digital, social media, TV/radio, and email/SMS. Print PR continues to champion, with over half of the respondents citing that ‘print is very much here’.

When asked about which channels the agencies were promoting, online (90pct) dominated the list however this was closely followed by print (87pct), social media (71pct), TV/radio (50pct), community and outreach (23pct), and outdoor (13pct).

Nearly 80pct of the respondents cited clients engaged mostly with routine PR activities followed by an equal weighing towards reputation building, brand positioning and product communications (65pct), with only 34pct on crisis response mitigation, followed by executive communications (25pct), internal communications (22pct), and ESG, DEI related (19pct).

However, their clients are also increasingly requesting for crisis response PR strategies (84pct) and internal communications (81pct), including ESG and DEI related activities and executive communications. These areas are a key highlight for 2024 and years to come in Sri Lanka, and agencies will need to gear up to bridge skills gaps to be counsel-ready.

Respondents stressed the following learning areas to get through 2024, with 69pct rating social intelligence, followed very closely by analytics, DEI, ESG, AI, storytelling, and domain specific knowledge.

Proving the PR value to clients continue to be the most pressing challenge in the PR industry (56pct), followed by client acquisition and talent retention (47pct), and securing coverage and exposure (31pct). The diminishing budgets among clients allocated for PR is the biggest challenge (81pct), followed by payment delays (60pct), and skills gap (41pct). The challenges their clients were facing include external and economic pressures (68pct), budget cuts (65pct), retaining talent (55pct), proving ROI to their leadership (52pct) and finding customers and markets (39pct).

Mental wellness in the PR industry should be a key priority. Over a two-third surveyed had mixed thoughts on this, and positively nearly half of them said they had a well-balanced approached. However, two-third of the respondents cited having experienced poor mental health at some point in 2023. Many stressed that they had to work long hours (29pct) and also often during weekends (29pct).

Learning (66pct) followed by agency reputation (62pct) was cited as why they work where they work, followed by networking, compensation, and job mobility. 29 out of 32 respondents said they had received training at some point, and a majority of them (83pct) have networked with other peers in the industry in the last twelve months. Self-learning (84pct) continues to lead, followed by on-the-job training, workshops, events, and related qualifications.

Over 80pct stressed that the PR industry needs to work more on knowledge sharing. This was followed talent and capacity building (65pct), collaboration and partnerships (62pct), networking, and uplifting its ethical standards.

Many PR agency leaders and executives commented that a shift towards digital channels is crucial but it should come with the required literacy and ethical framework, and concerns on the widening skills and knowledge gap between experienced PR professionals and freshers need to be addressed, including advocating as a whole on the long-term impact and investment of PR among clients. Some also suggested that social and behavioral research, data-driven skills, transparency in communications, agility and collaboration, tech integration, and continuous learning are paramount to stay ahead in delivering impactful and resonating communications.

Country Rep Thanzyl Thajudeen, who is a Board Member of PRCA APAC and Council Member of PRCA, and also sits in the Membership Committee, also extended his heartiest congratulations on the inaugural launch of the local PR association, and believes that the industry will work together collaboratively to address the issues and challenges, and keep evolving to take the industry to a global stage.

The Public Relations and Communications Association (PRCA) is the world’s largest professional PR body.

We represent more than 35,000 PR professionals in 82 countries worldwide. With staff in London, Hong Kong, Dubai, Singapore, and Buenos Aires, we are a global advocate for excellence in public relations. We also manage the International Communications Consultancy Organisation (ICCO) – the umbrella body for 41 PR associations and 3,000 agencies across the world, and LG Comms – the UK’s national body for local government communicators. Additionally, we support the delivery of the Motor Industry Communicators Association (MICA). The Sri Lanka representative can be reached via [email protected].

Thanzyl Thajudeen, PRCA APAC Board Member and PRCA Council Member

Some of the key highlight findings of the survey

LankaTalks Editor

LankaTalks Editor