The continued trend of high bidding observed at last week’s Treasury bill (T-bill) and Treasury bond (T-bond) auctions, despite the surge in market liquidity, has raised questions about whether the excess liquidity is concentrated among only a few market participants.

Speaking to The Sunday Morning Business, First Capital Holdings Chief Research and Strategy Officer Dimantha Mathew pointed out that, consistent with recent trends, the Central Bank of Sri Lanka (CBSL) had once again failed at last week’s auction to sell the entire stock of T-bills, as well as the five-year T-bonds offered.

He noted: “What we are seeing is that there is an upward push on the bidding that is coming in. However, the CBSL is not too happy about accepting at those levels. The dissatisfaction is understandable, because liquidity in the market has returned to Rs. 160 billion.”

Therefore, he admitted that it remained a question as to why bids continued to come in at the higher end despite the ongoing surge in liquidity

“Perhaps some banks are short [on liquidity] due to high borrowing or lending requirements. I feel that because of high lending requirements, perhaps there is a slightly less attractiveness to invest at these levels and that is pushing the rates upwards,” he added.

However, Mathew also admitted that, considering the significant improvement in market liquidity, it was possible that this excess liquidity was isolated to a few banks, creating confusion in the market.

“That’s the feeling we are getting because the liquidity has to be somewhere,” he stated.

According to statistics published by the CBSL, it had received bids worth Rs. 128.6 billion for the Rs. 77 billion worth T-bills offered at Wednesday’s (10) auction.

The CBSL had accepted bids worth Rs. 5.2 billion for three-month T-bills at a Weighted Average Yield Rate (WAYR) of 7.58%, Rs. 48.2 billion for six-month T-bills at a WAYR of 7.89%, and Rs. 5.8 billion for 12-month T-bills at a WAYR of 8.02%.

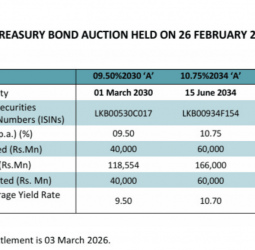

Commenting on the results of Thursday’s (11) T-bond auction, Mathew noted that the CBSL’s failure to sell the entire stock of five-year T-bonds, while fully selling other tenors, was likely influenced by the current steep yield curve.

“Our yield curve is quite steep, where the five-year bond is trading below 10% at around 9.5%, while the seven-year and 10-year bonds are trading at close to 10.5% and 11%, respectively.

“Therefore we have a substantial gap there, which probably makes the mid- to longer-term tenors more attractive, while the five-year and shorter tenors are less attractive, particularly considering the lending demand that exists.”

The CBSL accepted only Rs. 46.2 billion worth of bids from the Rs. 110.6 billion received for the five-year T-bonds at a WAYR of 9.76%. Meanwhile, it fully sold the Rs. 25 billion of seven-year T-bonds offered at a WAYR of 10.45% and the Rs. 45 billion of 10-year T-bonds at a WAYR of 10.96%.

Source: Themorning

Natasha

Natasha