Marking a milestone initiative to strengthen Sri Lanka's dairy industry, DFCC Bank has allocated Rs. 500 million to finance smallholder dairy farmers, in line with its commitment to supporting sustainable development. This dedicated initiative by DFCC Bank is the brainchild of the bank's MSME (Micro, Small, and Medium Enterprises) Unit and is built upon the successful experience of lending to the beneficiary farmers of the USDA-backed Market-Oriented Dairy (MOD) Programme. This special credit line, made available entirely by DFCC Bank, aims to provide crucial support to the sector under concessionary interest rates, fostering growth at the grassroots level, particularly amongst smallholder dairies, which form a significant part of Sri Lanka's dairy industry.

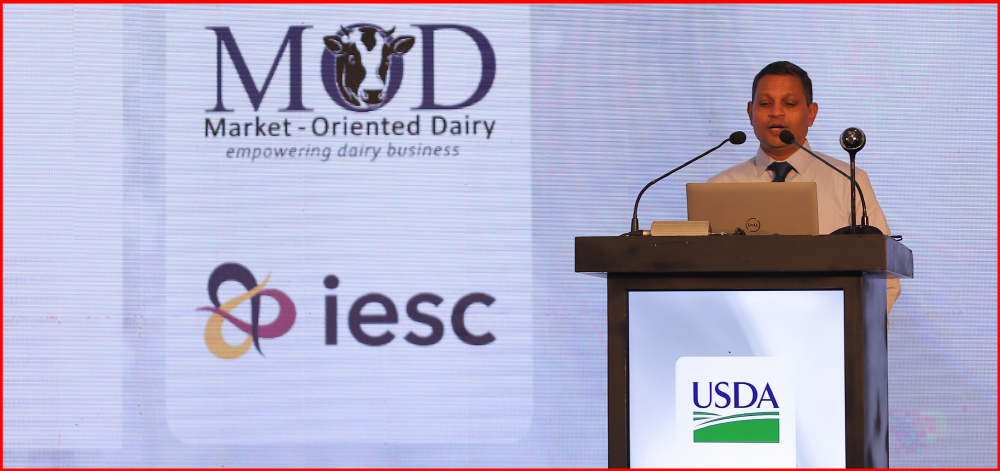

Chandana Wanigasena, Vice President | MSME at DFCC Bank, made the announcement during the closeout event of the Market-Oriented Dairy (MOD) programme. The "Sri Lanka Dairy—The Art of the Possible" event took place at the Galle Face Hotel on May 17, 2024. It celebrated the MOD programme's achievements supporting Sri Lanka's dairy smallholders.

At the event, Chandana highlighted the remarkable progress made by DFCC Bank's MSME Unit, which has successfully financed over 2,500 dairy farmers through a value chain financing model supporting MOD's efforts to transform dairy farmers into entrepreneurs. This model has significantly contributed to the industry's growth, exemplifying an effective and scalable approach to agricultural financing.

Chandana explained, "DFCC Bank allocating this substantial fund underscores the Bank's unwavering commitment to the dairy sector. By supporting the proposed DFCC-MOD Dairy Farmer Loyalty Programme and the MOD's proven model of creating a pool of dairy entrepreneurs producing 100 litres daily, we are taking concrete steps to enhance smallholder dairy farmers' financial sustainability and growth prospects."

The initiative demonstrates a substantial financial investment into the dairy sector and highlights the bank's strategic focus on critical industries with the potential for significant economic and social impact in Sri Lanka. Offering financing under concessionary interest rates makes the initiative highly attractive and beneficial for smallholder farmers. The focus on value chain development, the adoption of 10 Key Performance Indicators (KPIs), and support for MOD's Climate-Smart Dairy (CSD) initiative further emphasise the bank's commitment to sustainable agricultural practices.

The Market-Oriented Dairy (MOD) Project, based in Sri Lanka, is funded by the United States Department of Agriculture (USDA) 'Food for Progress' initiative, and implemented by Improving Economies for Stronger Communities (IESC), a Washington DC-based not-for-profit organisation. The project's efforts to double the milk production of participating dairy farmers to enhance their technical knowledge and create an entrepreneurial, business-oriented mindset helped farmers make intelligent investments, and the bank assessed and lent with confidence.

Through targeted support to drive sustainable development within critical industries in Sri Lanka and a strong emphasis on value chain financing, DFCC Bank plays a pivotal role in transforming the dairy sector and ensuring its long-term sustainability and prosperity.

About DFCC Bank

DFCC Bank is a full-service commercial bank with a rich history of 68 years and offers a diverse range of commercial and development banking services. As part of its Sustainability Strategy 2020-2030, the Bank aims to become a leading institution contributing to greater resilience by creating resilient businesses and supporting green financing and sustainable, socially responsible entrepreneurship. The Bank has received numerous accolades, including being named the 'Most Trusted Retail Banking Brand' and the 'Best Customer Service Banking Brand' in Sri Lanka in 2021 by Global Brands Magazine UK and 'Market Leader and Best in Service in Cash Management 2022' by Euromoney. Additionally, DFCC Bank is ranked among Business Today's Top 40 Corporates in Sri Lanka, is rated A- (lka) by Fitch Ratings Lanka Limited and is regulated by the Central Bank of Sri Lanka. Attesting to its commitment to sustainability, DFCC Bank is also the first, and presently only, entity in Sri Lanka to have received accreditation from the Green Climate Fund (GCF), granting it access to concessionary funding worth USD 250 million to support climate mitigation and adaptation projects across the Island.

Thishila Mewan

Thishila Mewan