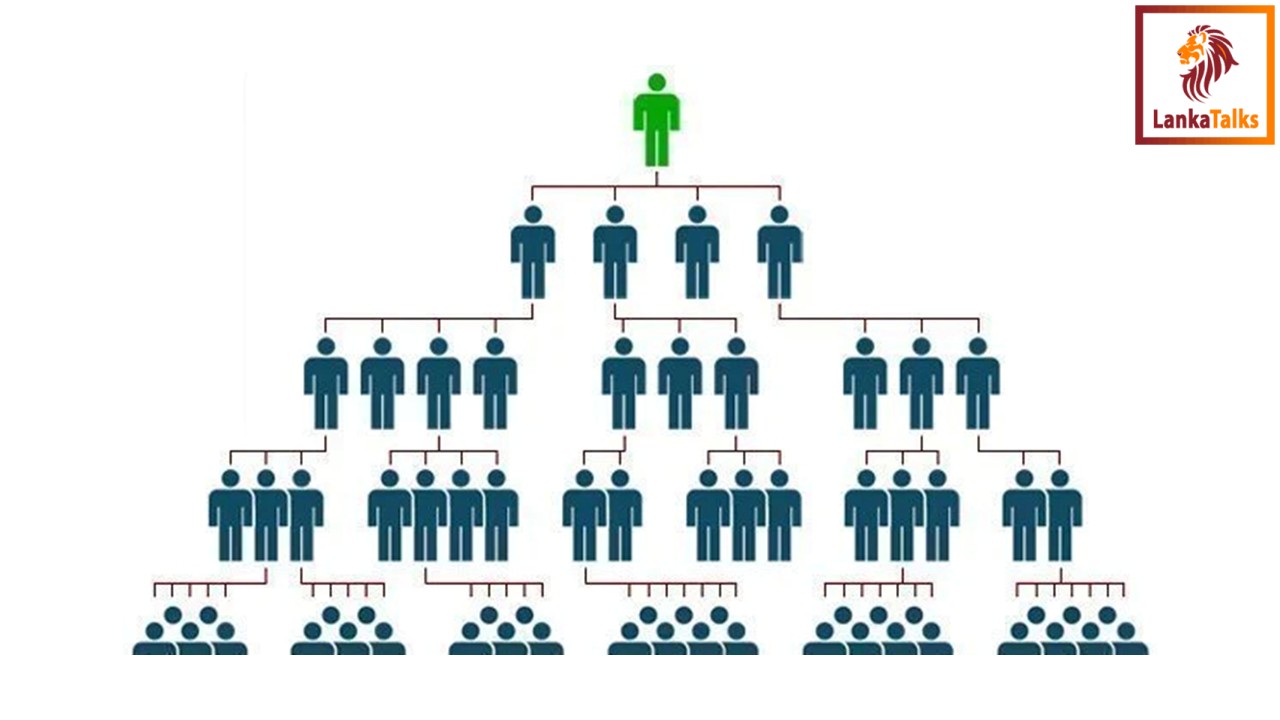

Section 83C(1) of the Banking Act prohibits activities related to the initiation, offering, promotion, advertisement, conduct, financing, management, or direction of prohibited schemes. By leveraging the investigative powers under Section 83C(3) of the Banking Act, CBSL aims to identify and mitigate such violations effectively, safeguarding both the integrity of the financial sector and interests of the public.

In addition, CBSL has provided information, documents, books and records obtained during investigations conducted under Section 83C(3) of the Banking Act to law enforcement authorities. CBSL has also collaborated closely with these law enforcement authorities to prosecute individuals or entities violating the provisions of Section 83C(1) of the Banking Act, particularly concerning the following 20 institutions since 2011 and currently, there are several other schemes being investigated.

- Tiens Lanka Health Care (Pvt) Ltd

- Best Life International (Pvt) Ltd

- Mark-Wo International (Pvt) Ltd

- V M L International (Pvt) Ltd

- Fast3Cycle International (Pvt) Ltd

- Sport chain app, Sport chain zs society Sri Lanka

- Onmax DT

- MTFE App, MTFE SL Group, MTFE Success Lanka, MTFE DSCC Group

- Fastwin (Pvt)

- Fruugo Oline App/Fruugo Oline (Pvt)

- Ride to Three Freedom (Pvt)

- Qnet

- Era Miracle (Pvt) Ltd and Genesis Business School

- Ledger Block

- Isimaga International (Pvt)

- Beecoin App and Sunbird Foundation

- Windex Trading

- The Enrich Life (Pvt) Ltd

- Smart Win Entreprenuer (Private) Limited

- Net Fore International (Private) Limited / Netrrix

Some of the matters are now before the courts and other matters are currently being investigated by law enforcement authorities with a view to filing actions. Therefore, in order to safeguard public from the risks of prohibited schemes, CBSL has continued to implement comprehensive public awareness programmes to educate the public regarding the dangers of engaging in these prohibited schemes while reporting to the relevant law enforcement authorities to institute legal actions against wrongdoers. Public awareness programmes include diverse methods to ensure maximum reach and effectiveness as detailed below:

Digital Media:

CBSL disseminates critical information about prohibited schemes through its official website and online publications, ensuring 24/7 accessibility for the public.

Press Notices:

A series of press releases have been issued to highlight the risks associated with prohibited schemes and provide guidance on avoiding them. These notices are widely circulated across various media outlets, reaching different segments of the public.

Awareness Sessions:

In 2023 and 2024, CBSL has organized more than 700 awareness sessions, engaging over 50,000 participants at its Regional Offices and the Head Office. These sessions allow direct interaction with the public, fostering understanding of prohibited schemes and promoting financial literacy. Collaboration with Social Media Influencers:

Recognizing the impact of social media, CBSL partnered with prominent social media influencers to amplify its message. These influencers shared informative content and personal testimonials, effectively reaching younger, tech-savvy audiences.

Accordingly, CBSL remains committed in its undertaking to protect the public from engaging in prohibited schemes and ensure the integrity of the financial sector. The Bank emphasizes the importance of continued vigilance and cooperation among all stakeholders in safeguarding the public interest and maintaining economic and financial system stability.

A.R.B.J Rajapaksha

A.R.B.J Rajapaksha