- The removal of a key tax refund system will create significant cash flow issues for exporters

- Exporters say the change could negatively impact smallholder farmers, who produce 75% of the country’s tea

Sri Lankan tea exporters will be mandated to spend roughly Rs. 2 billion each week in value-added taxes (VAT) when purchasing their recorded weekly average of five million kilogrammes of tea at tea auctions, which could lead to smallholder farmers being dissuaded from producing tea, Eswaran Brothers Chairperson Ganesh Deivanayagam said.

Speaking at a press conference held on the impending removal of the simplified value added tax (SVAT) refund system which is scheduled for 1 October, Deivanayagam said: “Even if the government (returns VAT refunds), we are going to require roughly Rs. 2 billion a week for the five million kilogrammes of tea that is purchased at the auction, every week.”

The SVAT is a mechanism that reduces the volume and amount of VAT refunds to be processed by the Inland Revenue Department, and thereby also minimises the cash flow impact of taxation before export on exporters.

Under the extended facility fund (EFF) with the IMF in 2023, Sri Lanka agreed to a structural benchmark to repeal the SVAT framework by April of this year, with the conventional VAT refund processing model replacing it.

However, during the 2025 budget, it was announced that SVAT would be formally abolished from 1 October.

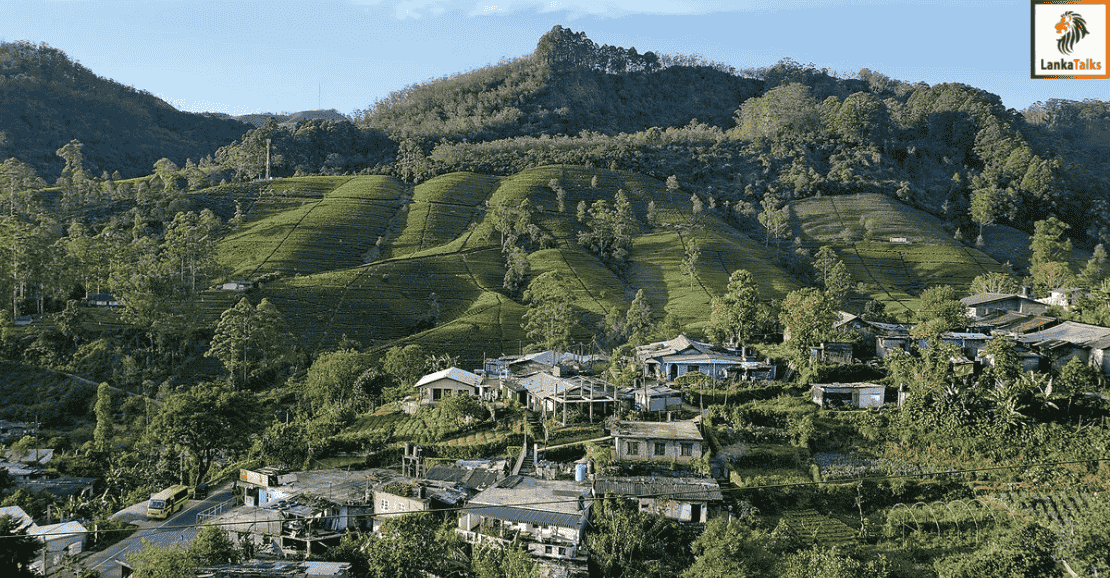

“Every week at the auction, five million kilogrammes of tea come from the smallholders, who are responsible for 75% of tea production. More importantly, this small-holder segment is going to get affected,” Deivanayagam said.

According to the Sri Lanka Tea Board - a government-owned statutory institution which regulates the industry - around 75% of overall tea production is from small-holder production, while the rest is produced by regional plantation companies (RPCs).

The IMF’s agreement stipulates that SVAT must be removed, however on the condition that there is a robust refund mechanism in place.

Explaining the rough calculations further, Deivanayagam added: “That Rs. 2 billion is going to be paid on an average (per week) for the five million kilos.”

Referring to the average cost of a kilo of tea, Deivanayagam said: “It’s Rs. 1,000 a kilo, which makes it Rs. 5 billion. So, Rs. 1 billion a week will be paid towards VAT roughly, and over 10 weeks it is Rs. 10 billion.”

“So Rs. 10 billion, the government is going to keep in hand, and they know they have to give it back. Who’s going to pay the interest for that Rs. 10 billion? It’s an additional cost for us.”

Deivanayagam pointed out that passing on the cost of a pending refund charge onto a consumer is not prudent for Sri Lankan exporters who compete with India and Kenya.

“We can’t charge that to the customer, because we have Kenya and India who do not have this extra cost. What we have to do then is pay less to the people who are producing the tea,” he said, emphasising that it is the small-holder that may be impacted on the immediate front.

“That interest cost roughly turns out to be about Rs. 5 a kilo of green leaf that is plucked. Immediately you’re going to get Rs. 5 less per kilo. As it is, the tea industry is suffering, because the income is not great, and there will be more people abandoning their smallholder plots of tea cultivation.”

Joint Apparel Association Forum Sri Lanka (JAAF) Secretary General Yohan Lawrence further clarified that though the mandate for the removal of the SVAT comes from the IMF - which Sri Lanka is closely following a macroeconomic stability programme with - the IMF’s own technical document states that the refund system that is to replace the SVAT is to be one that has been tested for function.

“There is an IMF mandate, but the mandate is also that there is a valid refund system in place.”

Lawrence reasoned that other mandated taxes, such as the digital tax, had been postponed in Sri Lanka after subsequent pushback.

“If you look at the VAT on digital taxes, it was being pushed back. Even SVAT, there has been push back because it is not ready. We do not believe that the IMF would want something that would cause a massive negative impact on the industry. If you look at the IMF technical document it says that there should be a pilot (of the replacement refund system). That pilot has not been done. Our task is that we put everything in place, to ensure a seamless refund system, before it is pulled.”

At present, the Sri Lankan government maintains that it will have a refund system in place which issues refunds within 45 days.

“Our issue is that it has not been tested. So the conversation about what has not happened, hasn’t taken place because of the government’s received commitment from Inland Revenue, and the Treasury is that it will take less than 45 days. As exporters we don’t believe the system is ready, and the request is to delay the decision until there is a proven system,” Lawrence concluded.

Source: The morning

Natasha

Natasha