Diversified conglomerate Sunshine Holdings PLC (CSE: SUN) has been included in the S&P Sri Lanka 20 Index, following the 2025 year-end index rebalance announced by the Colombo Stock Exchange (CSE) and S&P Dow Jones Indices. The inclusion takes effect from 22 December 2025, after market closing on 19 December 2025.

The S&P Sri Lanka 20 Index represents the 20 largest and most liquid companies listed on the CSE, selected based on stringent criteria including market capitalisation, liquidity, financial viability and sustained profitability. Constituents are weighted by float-adjusted market capitalisation, with a single-stock caps to ensure balanced representation.

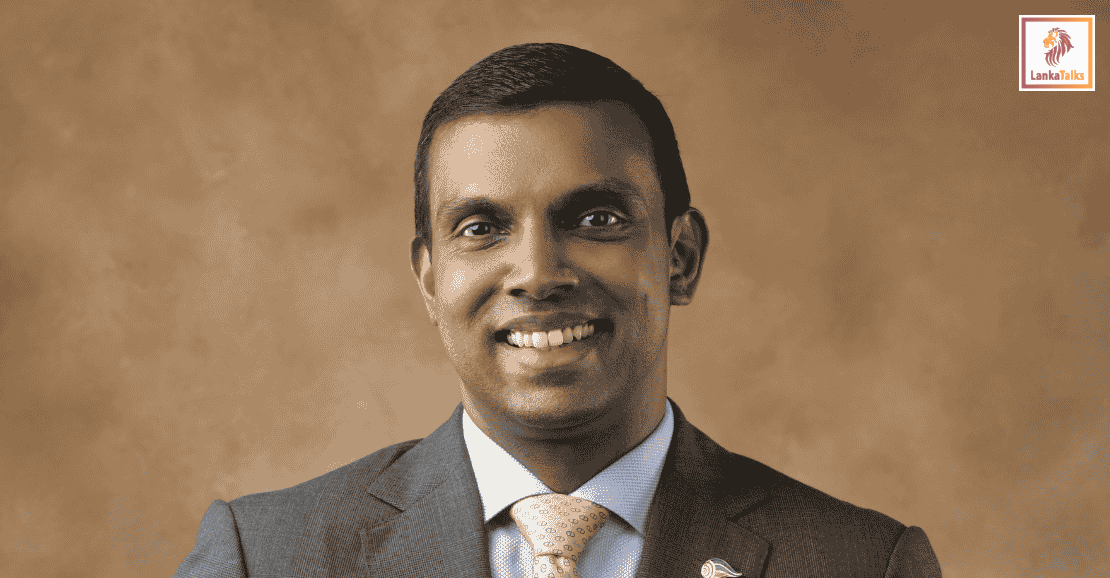

Commenting on the milestone, Sunshine Holdings Group Chief Executive Officer, Shyam Sathasivam, said, “Our inclusion in the S&P Sri Lanka 20 is the result of more than five decades of collective effort and perseverance by our people, past and present, who have built Sunshine Holdings into the institution it is today. This recognition reflects the strength of our foundations, the discipline with which we have grown, and the consistency of our performance across business cycles. As we move forward, we remain focused on building resilient businesses, upholding strong governance standards and delivering sustainable long-term value to all stakeholders.”

The S&P Sri Lanka 20 Index is constructed in line with global index methodologies and international best practices, with all constituents classified under the Global Industry Classification Standard (GICS®). Eligibility requires a minimum float-adjusted market capitalisation of Rs. 500 million, a six-month median daily value traded of Rs. 250,000, and positive net income over the twelve months preceding the rebalancing reference date.

Sunshine Holdings’ inclusion in the S&P Sri Lanka 20 reflects the Group’s long-term capital markets journey, evolving from a closely held family enterprise into a widely held blue-chip listed company. Over the years, the Group has focused on building institutional credibility, strengthening governance standards and expanding its shareholder base, resulting in a current market capitalisation of approximately LKR 70 billion, underscoring its scale and relevance within the Colombo Stock Exchange.

In parallel, Sunshine Holdings has taken deliberate steps to enhance stock liquidity and investor participation through timely corporate actions, including share splits implemented over recent years. These initiatives have contributed to sustained trading activity in the stock, with a six-month median daily value traded of Rs. 45.6 million, comfortably exceeding the liquidity thresholds required for inclusion in the S&P Sri Lanka 20 Index.

With a legacy spanning over 58 years, Sunshine Holdings plays a key role in Sri Lanka’s nation-building efforts through its presence in healthcare, consumer and agribusiness sectors. The Group is home to leading local brands including Zesta Tea, Watawala Tea, Ran Kahata, Daintee, Milady, Healthguard Pharmacy and Lina Manufacturing. Employing nearly 2,000 people, Sunshine recorded LKR 59.3 billion in revenue in FY25, underscoring its scale, performance and growing appeal to local and international investors.

Natasha

Natasha