Diversified conglomerate CIC Holdings PLC (CSE: CIC) reported a consolidated revenue of Rs. 41.6 billion for the first half of the financial year 2025/26 (1HFY26). The Group reported a solid top-line growth of 7.2% and an impressive bottom-line growth of 14.7% with Profit after tax (PAT) increased to a significant Rs.3.25 billion, compared to Rs. 2.83 billion in the corresponding period of the previous year. The Group’s performance was underpinned by strong margin recovery, improved operating efficiency, and continued demand resilience, despite the delayed onset of the Maha cultivation season due to delayed rainfall patterns and resultant higher stock holding.

Operating profit (EBIT) strengthened to Rs. 5.7 billion, recording 18.6% YoY growth, while profit before tax rose to Rs. 4.9 billion (up 19% YoY). During the period under review, Crop Solutions remained the Group’s largest revenue contributor, accounting for approximately 40% of consolidated revenue. Livestock Solutions (including Feeds and Nutrition) and Health and Personal Care each contributed around 22%, reflecting steady demand and continued operational strength. The Industrial Solutions segment contributed 9.33%, while Agri Produce accounted for around 6.6% of Group turnover.

Gross profit increased to Rs. 11.2 billion, representing 11.68% year-on-year growth, supported by disciplined pricing and an improved product mix. Gross profit margin stood at approximately 27%, reflecting a notable margin improvement compared to the previous year, despite the delayed Maha season and the resultant cost pressures. Importantly, this solid performance was recorded during CIC’s historically softer second quarter, underscoring the Group’s operational consistency and diversified earnings base.

During the period in review, key Group businesses under the five industry sectors, which are Crop Solutions, Agri Produce, Livestock Solutions, Industrial Solutions and Health/Personal Care all performed resiliently. Crop solutions revenue grew from Rs.14.9 billion to Rs. 17.1 billion, Health and Personal Care revenue grew from Rs. 9.18 billion to Rs. 9.45 billion and Livestock Solutions also delivered growth, with revenue rising from Rs. 8.74 billion to Rs. 9.46 billion. Revenue from Agri Produce and Industrial Solutions remained stable by achieving Rs, 2.84 billion and Rs. 4.02 billion.

In terms of profitability, Crop Solutions recorded a segmental profit of Rs. 2.11 billion, reflecting a 16% year-on-year increase with Livestock Solutions delivering Rs. 1.16 billion in segmental profit, marking a strong 32% growth. The Health & Personal Care sector also recorded notable earnings growth, with segmental profit rising to Rs. 1.30 billion, an increase of 33% compared to the previous year . Overall, the Group’s five core business sectors generated Rs. 5.40 billion in segmental operating profit, representing a 16% year-on-year increase, reinforcing broad-based earnings resilience across key operating verticals.

The Group’s earnings per share (EPS) increased from Rs. 6.12 to Rs. 6.86, reflecting a 12% year-on-year improvement pre split , supported by stronger operating profitability across key business segments. The balance sheet remained robust, with total assets reaching Rs. 98.6 billion, positioning the Group close to the Rs. 100 billion milestone.

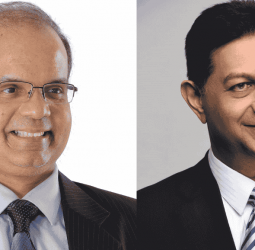

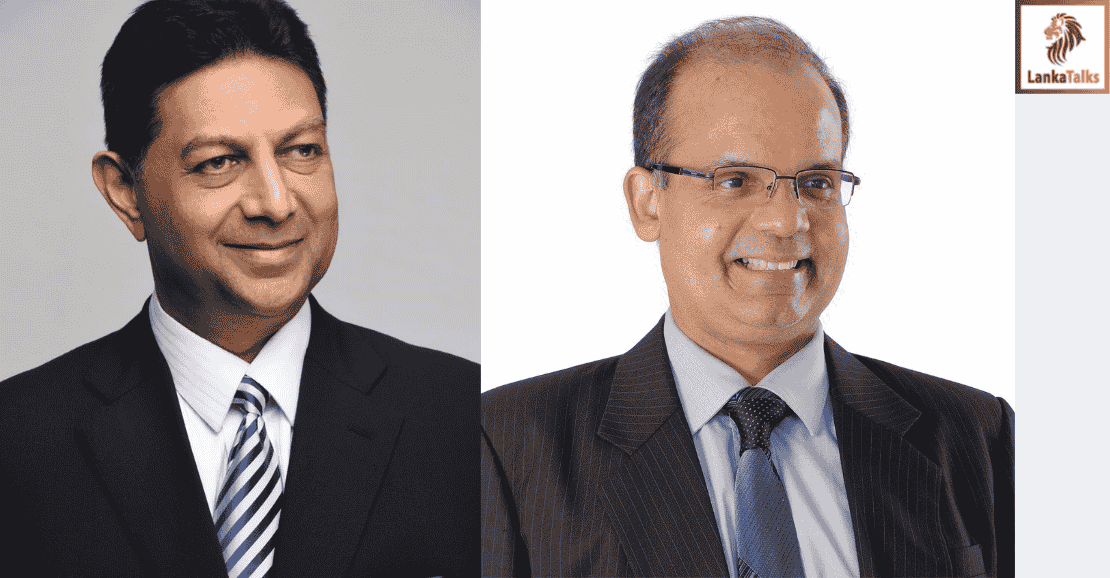

Commenting on the performance, CIC Holdings Group CEO Aroshan Seresinhe said, “This performance reflects the strength of our diversified portfolio and the resilience of our teams. Even with the delayed Maha season, we sustained continuity across our agri value chains and healthcare networks, while maintaining margin discipline and operational efficiency. Our focus remains on reinforcing the country’s agriculture infrastructure and advancing science-led solutions that support food security, productivity, and community livelihoods. As the operating environment stabilises, we will continue to invest responsibly, strengthen our partnerships across the farmer ecosystem, and create sustainable, long-term value for all our stakeholders.”

Natasha

Natasha