Sri Lanka’s economic recovery, moderating inflation and lower interest rates are poised to spur finance and leasing companies’ (FLCs) performance in the financial year ending March 2025 (FY25), says Fitch Ratings in a report.

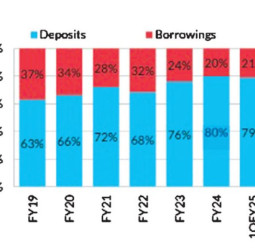

The loan growth will also be supported by further relaxation of vehicle import restrictions imposed since 2020 to preserve the country’s foreign reserves. Economic growth turned positive from 4Q23 following six quarters of contraction, and monetary conditions have eased significantly. The normalisation in inflation and interest rates amid a revival of economic activities has boosted FLCs’ credit demand, particularly in the key vehicle-financing segment. FLC sector loan growth expanded by an estimated 9.6% yoy in 1QFY25 (FY24 estimate: 2.2%).

“GDP expanded by 5.0% yoy in 1H24 while private sector credit growth improved to 4.6%yoy in 8M24 (2023: -0.6%) amid easing monetary conditions.” This backdrop should support FLCs’ loan growth, asset quality and profitability.

“We expect asset quality to improve further on recovering borrower repayment capacity and FLCs’ focus on loan recoveries. The industry’s 90 days past due non-performing loan ratio eased to 13.6% by 1QFY25 from 17.8% at end-December 2023.”

Profitability will be supported by lower funding and credit costs, with return on assets rising to 5.5% in FY24 from 3% in FY23. Sri Lanka’s ongoing economic recovery remains fragile and sensitive to the progress of its economic reform programme, with any significant slippages potentially raising risks to the sector’s growth, asset quality and earnings and standalone credit profiles.

“The ratings implications will depend on whether the ratings are driven by entities’ standalone credit profiles or external support, taking into account relativities with other rated entities in Sri Lanka. “We also expect asset quality to improve due to better borrower repayment capacity. The industry’s reported 90 days past due (dpd) non-performing-loan ratio eased to 13.6% by end-1QFY25 from 17.8% at end-December 2023, which signals lower credit costs ahead.”

“We expect a further relaxation in vehicle import restrictions towards 1H25, but on a staggered basis.” Sri Lanka began to relax some restrictions on vehicle imports, specifically for selected public passenger vehicles, goods transport and other special purpose vehicles from August 2023. Broad curbs on vehicle imports have been in place since 2020 to conserve foreign currency reserves.

“The anticipated import duties will also increase the landed price of the incoming vehicles, which should provide support for used-vehicle prices in Sri Lanka.”

Mifra

Mifra