HNB Assurance PLC (HNBA) and HNB General Insurance Limited (HNBGI) have both been reaffirmed by Fitch Ratings with an ‘A-(lka)’ rating indicating an outlook which is stable, signaling confidence in the companies’ financial health and future growth potential.

Fitch highlighted that HNBA and HNBGI have strengthened their investment portfolios and maintained healthy liquidity as the Sri Lankan economy recovered. A major part of their investments is in government securities, term deposits and corporate bonds, making them well-poised to venture forward.

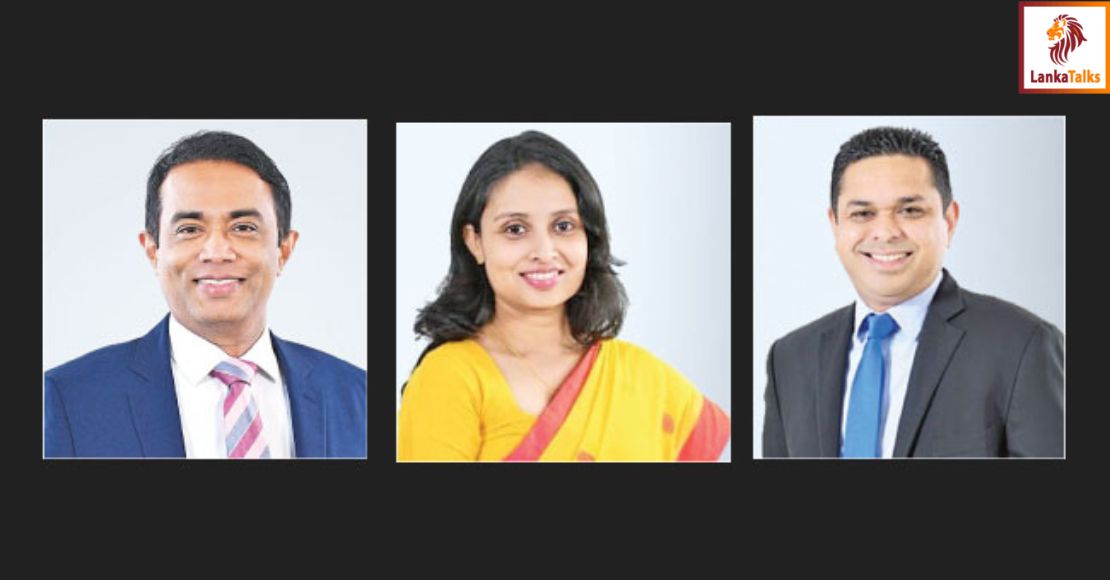

HNBA’s CEO, Lasitha Wimalaratne, commented, “Even though we’ve faced many challenges recently, we remained focused on building a steady and sustainable business while putting our customer’s interests at the heart of everything we do.”

“By effectively managing the factors within our control, we successfully strengthened our position, which includes growing our advisor network, enhancing our bancassurance partnerships and being innovative with our product offering.

“These efforts have enabled us to grow faster than the industry average, showcasing the strength and adaptability of our approach. This reaffirmed rating is not just a measure of our financial stability, it is also a strong endorsement of the trust our policyholders have in us.”

According to Fitch, HNBGI continued to expand its non-motor segments and implemented enhanced claim management systems to better manage its position. This has led to lowered claims ratios and an improvement in HNBGI’s underwriting profitability in the first half of 2024.

“Expanding beyond motor insurance has helped us remain resilient in an unpredictable and challenging market” stated Sithumina Jayasundara, CEO of HNBGI.

“By diversifying our portfolio, we are better equipped to meet the evolving needs of our customers, which have led us to achieve a balance between our motor and non-motor segments. This balance has been the key to our growth strategy, helping us reach new customer segments and reduce reliance on a single line of business.”

The Group’s CFO, Punsirini Perera, stated, “This rating highlights our disciplined approach to managing finances and strengthening our capital, which gives a reassurance to our policyholders that we are well-prepared for the future. Both HNBA and HNBGI maintain strong Risk-Based Capital levels that exceed regulatory requirements and our close association with our parent company, Hatton National Bank, one of Sri Lanka’s leading banks, has helped us amplify our reach and influence in the market, positioning us uniquely to offer greater security and peace of mind to our customers.”

Mifra

Mifra