The Monetary Policy Board of the Central Bank of Sri Lanka has decided to maintain its policy interest rates at their current levels. The Standing Deposit Facility Rate (SDFR) remains 8.25%, while the Standing Lending Facility Rate (SLFR) is 9.25%. The Statutory Reserve Ratio (SRR) is also unchanged at 2.00%.

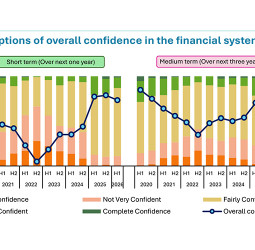

The Board arrived at this decision after carefully considering the recent and expected macroeconomic developments and possible risks and uncertainties on the domestic and global fronts to ensure that inflation aligns with the target of 5 per cent over the medium term while enabling the economy to reach its maximum potential. The Board observed that inflation will likely remain well below the target of 5 per cent over the next few quarters, potentially recording deflation in the immediate future driven by changes to administratively determined prices and easing supply conditions.

In addition to maintaining these rates, the Central Bank has been actively purchasing foreign exchange from the domestic market to enhance Gross Official Reserves (GOR). As of August 2024, GOR stood at US$ 6.0 billion, including a swap facility from the People’s Bank of China.

Mifra

Mifra