Cable Solutions Limited (CSLK), one of Sri Lanka’s leading specialised integrated cable manufacturer, stands at the forefront of innovation in the cable manufacturing industry. As CSLK prepares for its initial public offering (IPO), it presents an excellent value opportunity for investors eager to capitalise on a company with a robust growth trajectory and a commitment to technological advancement. This article explores the economic potential of CSLK and its strategic positioning in the global market.

Customer-Specific Cable Technology

One of the key differentiators for CSLK is its ability to manufacture highly customised cables for specialized applications. The company’s R&D team, composed of expert engineers, specialises in designing superior performance cables tailored to diverse applications, including extreme temperatures, confined spaces, and harsh environmental conditions.

A prime example of CSLK’s innovative spirit and customer-customisability is its “CableBuilder” solution, which is an advanced tool that allows customers to tailor solutions that are fine-tuned to their specific requirements. The company then designs precise, cost-effective and bespoke cables, delivered in time, to support the customers’ businesses. These abilities, coupled with CSLK’s deep technical expertise and proven processes, has strengthened the company’s reputation as a leader in cable manufacturing, globally.

Expanding Operational Capacities and Market Reach

Continuously gearing for growth, CSLK has strategically invested in expanding its operational capacities. Notable investments include the acquisition of Neihoff Buncher and Neihoff Multi Wire Drawing machines in 2020, Twister Machines in 2022, and high-speed Extruder Machines in 2024. These investments have significantly enhanced CSLK’s production capabilities. In addition, CSLK has expanded its harness capacity and capabilities, further improving its operational efficiency.

In the past five years, CSLK has also diversified its cable portfolio to tap into fast-growing sectors such as power transmission (solar cables), automotive (FLRYB cables), and specialised cables for optical instrumentation, automatic door control systems, and truck trailer control systems. Focusing on high-value sectors such as automotive, aerospace, electronics, and renewable energy, CSLK has successfully integrated itself into these global supply chains. The company’s strategic expansion into markets across the USA, Europe, and India positions it for a very robust growth in the coming years.

Sustainable Growth Based on Innovation

Innovation remains the cornerstone of CSLK’s strategy, driving market expansion and increased market share. Accordingly, CSLK has entered the electric vehicle (EV) charging and renewable energy markets, and the development of moulded cables for various instrument applications. By catering to the EV market and the renewable energy sectors, CSLK is capitalising on emerging strong growth opportunities that are also sustainable. These innovations have helped broaden both product offerings and customer base.

Sustainability is a critical aspect of CSLK’s growth strategy. The company prioritises environmentally friendly and sustainable growth through initiatives such as recycling water and growing their own plants, installation of solar power generation arrays at its facilities, and ISO 14001:2015 certification for environmental systems management. Through these initiatives CSLK has achieved 100% carbon neutrality and is working towards achieving a net zero target in the medium term.

Seizing Emerging Opportunities

The cable technology industry is poised for significant growth over the next decade, driven by key economic drivers such as the rapid expansion of the load cell industry, the AI and automation robotics industry, the evolving automotive ecosystem, and increasing demand for process instrumentation and solar power. CSLK is well-positioned to leverage these developments to drive sustainable growth.

Looking ahead, the company envisions becoming one of the top 10 cable manufacturers for the electronics industry in Asia and Europe by 2028. To achieve this vision, CSLK continues to invest in advanced technology, infrastructure, and strategic market expansions. Its upcoming IPO attests to this commitment to growth and innovation.

Massive Potential for Growth in Performance

CSLK’s potential for growth is underscored by its impressive revenue performance and strong export orientation. In the fiscal year 2023, the company generated revenues exceeding LKR 3.3 billion, with exports to 13 countries accounting for 94% of this revenue. CSLK’s highly customized and client driven products have returned 30%+ average Gross Profit Margin and 15%+ average Return on Equity over the past five years. CSLK’s diverse markets include major economies such as the USA, UK, Spain, Italy, Germany, Sweden, Switzerland, Russia, India, Australia, and New Zealand. This global footprint demonstrates CSLK’s ability to meet international standards, together with its resilience and adaptability in the competitive global market.

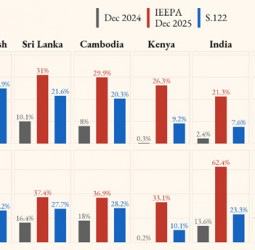

For investors, CSLK’s IPO at an offer price of LKR 7.50 per share presents an exceptional value proposition. Based on the independent valuation conducted by KPMG, the company’s implied price to earnings ratio based on FY25E earnings is ~9 times which is at a significant discount to the adjusted average regional peer multiple of ~12 times and the five-year average peer multiple of comparable export counters listed in Colombo Stock Exchange of ~12 times. CSLK’s year-to-date performance for FY25 has been on a robust growth trajectory, driven by a significant increase in demand in the global marketplace, which reinforces the company’s confidence in its future growth prospects. With a heavily export-oriented business model, unique market position, innovative product offerings, and proven track record, the company is poised for robust and sustainable growth, making it an attractive investment opportunity.

CSLK’s IPO comprises of an offer for sale and offer for subscription. CSLK expects to raise LKR 109,999,500/- by way of offer for subscription at an offer price of LKR 7.50/-. The issue will open on the 23rd of July 2023, and the funds raised will go towards machinery and production line development (81.8%) and working capital (18.2%). Broad-based interest is expected, including from overseas investors. For more details on the IPO, refer the prospectus at https://www.cse.lk/pages/primary-issues/primary-issues.component.html.

Thishila Mewan

Thishila Mewan