· Operating Income of LKR 11.9Bn up 3% YoY

· Stage 3 loan ratio reduced to 2.1%

· Profit After Tax of LKR 3.7Bn, up 35% YoY

· Total Capital Adequacy Ratio of 18.7%

· Liquidity Ratio of 45%

Nations Trust Bank PLC reported a strong performance in the first 3 months of 2024, posting a Profit Before Tax (PBT) of LKR 7.5 billion, up 28% year-on-year (YoY) and a Profit After Tax (PAT) of 3.7 billion, up 35% YoY.

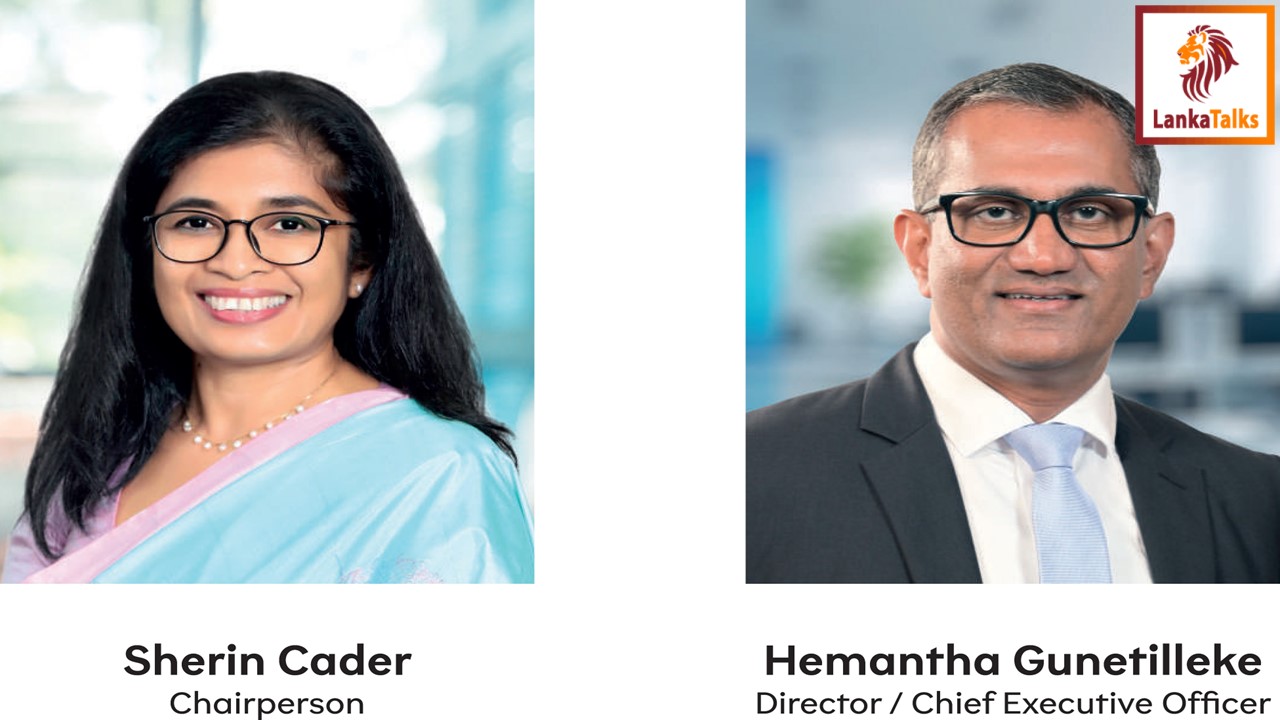

Commenting on the results, Hemantha Gunetilleke, Director & Chief Executive Officer of Nations Trust Bank said, “The Bank recorded a strong first quarter, highlighting steady growth across our customer segments. The Bank’s strong capital base, healthy liquidity buffers, robust risk management models and continued focus on digital empowerment are the fundamental strengths that continue to drive our performance”.

Underpinning the Bank’s financial performance is its strong capital position with Tier I Capital at 17.33% and Total Capital Adequacy Ratio of 18.76%, well above the regulatory requirement of 8.5% and 12.5% respectively.

Nations Trust Bank also maintained strong liquidity buffers with a Liquidity Ratio of 45% against the regulatory requirement of 20%.

The Bank’s Return on Equity (ROE) increased from 21.3% in December 2023 to 24% in 1Q2024. Accordingly, Earnings Per Share rose to LKR 11.58 compared to LKR 8.56 during the same period last year.

Nations Trust Bank PLC serves a diverse range of customers across Consumer, Commercial and Corporate segments through multi-channel customer touch points spanning both physical and digital. The Bank is focused on digital empowerment through cutting-edge digital banking technologies, and pioneered FriMi, Sri Lanka’s leading digital banking experience. Nations Trust Bank PLC is an issuer and sole acquirer of American Express Cards in Sri Lanka with market leadership in the premium segments.

A.R.B.J Rajapaksha

A.R.B.J Rajapaksha